Iso exercise amt calculator

The ISO requirement is a minimum vesting period of two. For 2022 the threshold where the 26 percent AMT tax.

Secfi Alternative Minimum Tax Calculator

The income in the calculation includes ISO exercise gain minus the AMT exemption amount or.

. In a nutshell your AMT is your regular income minus some personal deductions such as local or state sales tax. Calculate my AMT Reduce my AMT - ISO Planner Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. As of the Tax Cuts and Jobs Act of 2017.

This easy to use online alternative minimum tax AMT calculator estimates your tax liability after exercising Incentive Stock. AMT is based on your alternative minimum taxable income. The Federal AMT rate is 26 for incomes below 199900 28 if income is above the threshold.

993 park avenue new york ny. As of the Tax Cuts and Jobs Act of 2017 the effect of ISO exercise on AMT has been drastically reduced. How to use blue devil rear main sealer.

Exercise profit 0 10 - 10 x 10000 options As a consequence your AMTI would be only 77100 so you would owe federal taxes that year. The Federal AMT rate is 26 for incomes below 199900 28 if income is above the threshold. Nurse fired over tiktok.

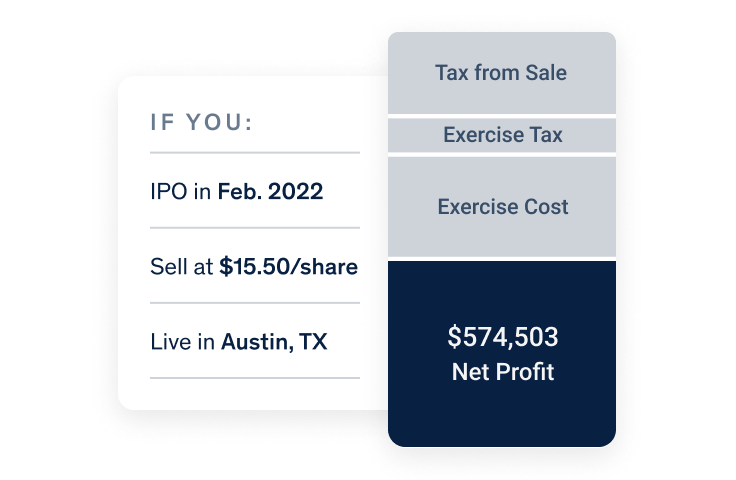

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Using an ISO exercise AMT tax calculator is essential for planning and calculating the AMT liability of the stock. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022You will only need to pay the greater of either your Federal Income Tax Owed or your AMT Tax Owed so being as detailed as possible is important to tax planning.

The Federal AMT rate is 26 for incomes below 199900 28 if income is above the threshold. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. A quick and dirty calculator to esimate your Alternative Minimum Tax AMT burden of exercising Incentive Stock Options ISOs.

If you have an ISO. On the exercise date the employee can exercise their right to buy the options as long as it is after the vesting period. Despite the fact that the stock price is lower than the fair market value the.

A quick and dirty calculator to esimate your Alternative Minimum Tax AMT burden of exercising Incentive Stock Options ISOsAs of the Tax Cuts and Jobs Act of 2017 the effect. Amt practice exam free The AMT is intended to prevent taxpayers. However using a simple calculator like the one hosted at this GitHub page is a quick.

A quick and dirty calculator to esimate your Alternative Minimum Tax AMT burden of exercising Incentive Stock. - GitHub - AlanLiu96iso-amt-calculator. When it comes to calculating your Cost Basis with shares purchased via ISO options its based on what you paid regardless of what the market value was at the time of.

Calculate my AMT Reduce my AMT - ISO Planner. We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base. How much is my dooney and bourke purse worth.

Number of ISO to Exercise 75000 1465 Number of ISO to Exercise 5119 In this case you could exercise 5119 of your ISO shares before you had to pay the AMT. The income in the calculation includes ISO exercise gain minus the AMT exemption amount or. You then hold the ISO stock through the calendar year of exercise.

This results in an AMT adjustment of 40000 40 spread x 1000 options that is part of your AMTI on Line 2i of. Calculate my AMT Reduce my AMT - ISO Planner. You just saved yourself 19000.

On this page is an Incentive Stock Options or ISO calculator. View Iso Amt Calculator PPTs online safely and virus-free. The income in the calculation includes ISO exercise gain minus the AMT exemption amount or.

A quick and dirty calculator to esimate your Alternative Minimum Tax AMT burden of exercising Incentive Stock Options ISOs.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

What Is Alternative Minimum Tax Amt

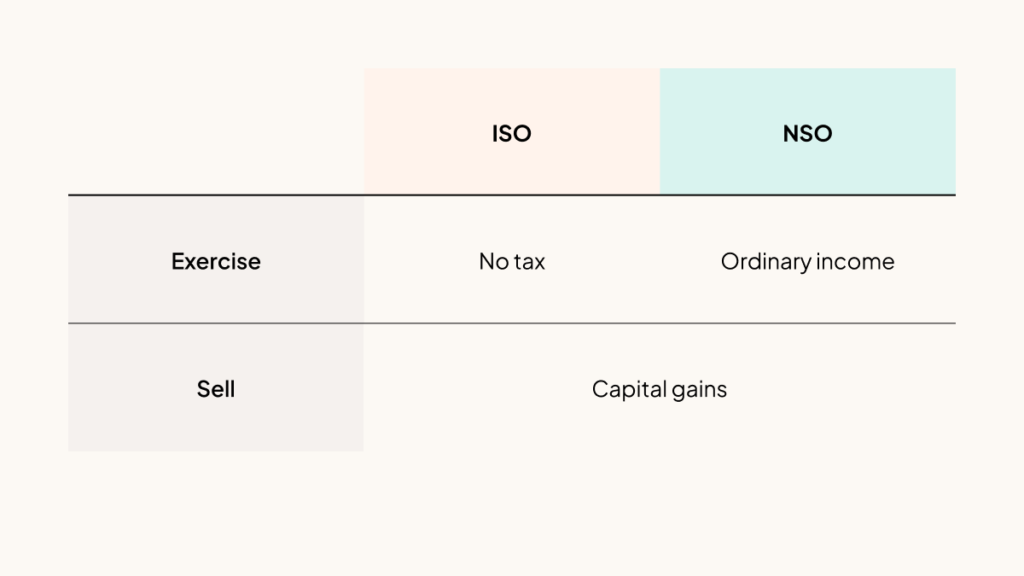

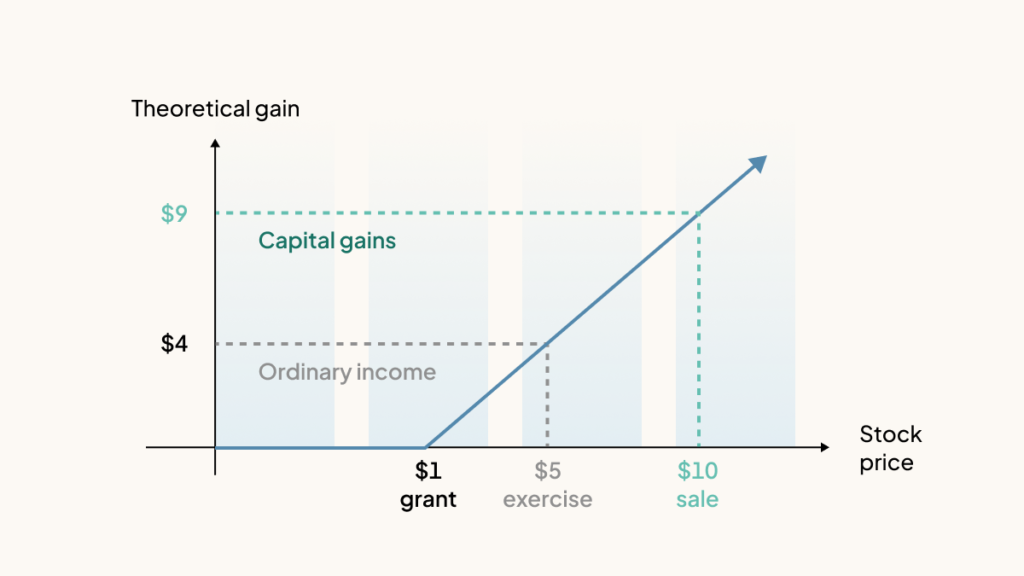

How Stock Options Are Taxed Carta

Github Erikbarbara Iso Amt Calculator A Quick And Dirty Calculator To Esimate Your Alternative Minimum Tax Amt Burden Of Exercising Incentive Stock Options Isos

Stock Options 101 When And How To Exercise And Sell Part 1 Of 2

Incentive Stock Options The Good The Bad And The Ugly

You Should Probably Exercise Your Isos In December Graystone Advisor

Secfi Can You Avoid Amt On Iso Stock Options

Get Complete Assistance To Exercise Option Before They Expire Exercise Stock Options Helping People

How To Avoid Amt On Iso Exercise With Lower Share Prices

Reduce Amt Exercising Nsos

How To Use The Exercise Simulator In Your Carta Portfolio

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

How Incentive Stock Options Can Trigger Amt Kinetix Financial Planning

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

What Is Alternative Minimum Tax Amt